How to Calculate Property Tax in Madinah 2025: A Comprehensive Guide to Understanding and Using the Tax Calculator 💰🏠

Amna Alazani | 17 فبراير 2025 | 8 مشاهدة

عقارات ذات صلة

Luxury residential apartments in 6th of October

شقة فاخرة في اللوتس بالساحل

فرصة عقارية مميزة في الشرقية, الطائف, محافظة الطائف, منطقة مكة المكرمة, 26511, السعودية

شقق سكنية راقية شارع الحمدي الحديدة

شقة في جرين بيتش الساحل الشمالي

محل للبيع بمارينا 4

مبنى سكني أراضي الإسكان

فرصة عقارية مميزة في محافظة صبياء, صبيا, منطقة جازان, 85454, السعودية

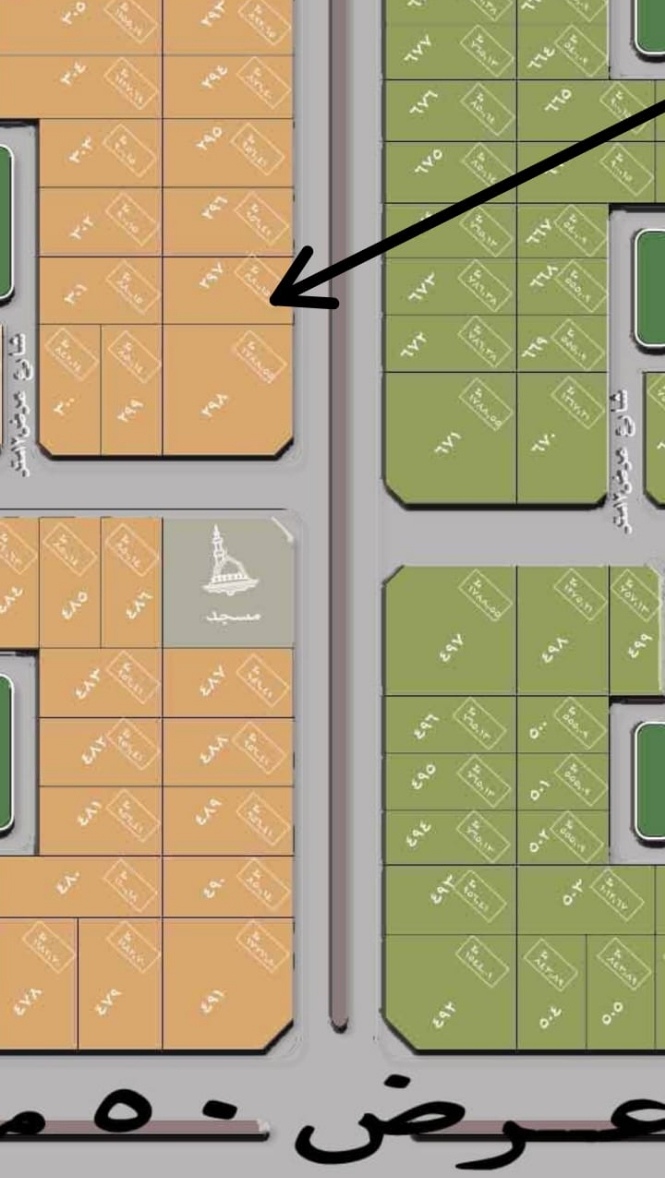

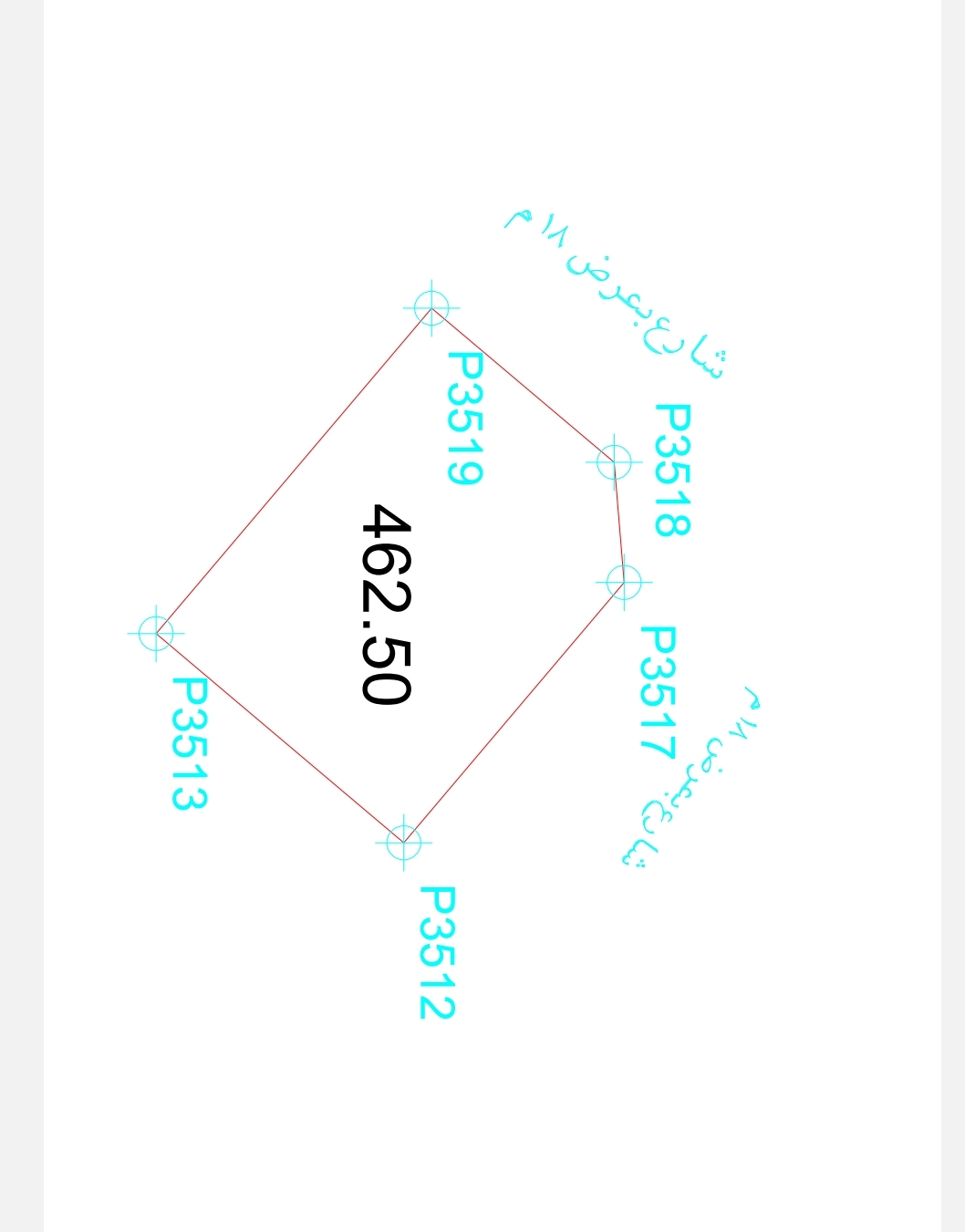

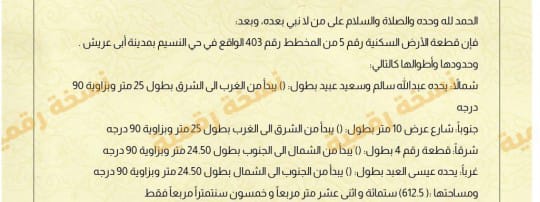

أرض في حي النهضة أبو عريش

شقة للبيع في الأندلس صنعاء

مقالات ذات صلة

Option 1 (Focus on Opportunity):

Madinah Calling! 🕋 Unlock prime business potential with Commercial properties for rent in Madinah 2025! Shops and offices at distinctive …

اقرأ المزيد

Option 1 (Focus on Luxury & Investment):

💎Unlocking Madinah's Real Estate Treasures!💎 Discover the Best Real Estate Offices in Madinah 2025, your gateway to luxury living & …

اقرأ المزيد

Unveiling the Best Real Estate Deals in Kuwait: A Treasure Trove of Opportunities

🌟 Uncover the Best Real Estate Deals in Kuwait: A Treasure Trove of Opportunities! 🌟 Attention all savvy homebuyers and …

اقرأ المزيد

آفاق جديدة للاقتصاد في غزة بعد إعادة الإعمار

غزة تنفض غبار الحرب، وتستنهض قواها نحو مستقبل مشرق! مع كل بيت يُبنى، تنمو معه آمال جديدة وفرص اقتصادية واعدة. …

اقرأ المزيدOption 1 (Focus on Location):

Madinah Calling! 🕋 Looking for Commercial properties for rent in Madinah 2025? Prime shops for rent 2025 & offices for …

اقرأ المزيد

Option 1 (Focus on Understanding):

Law of Land Disposal in Makkah 2025: Your Rights Explained! 📜 Navigating Saudi's real estate landscape? Understand the Law of …

اقرأ المزيد

Option 1 (Focus on Investment):

How to Evaluate Real Estate in Jeddah 2025: A Comprehensive Guide for Appraisers and Experts to Determine the Fair Value …

اقرأ المزيد

First Time Home Buyer Secrets: Your Key to Homeownership

Okay, here's a social media post draft: Thinking about taking the leap into homeownership? Buying your first home can feel …

اقرأ المزيد

دليل نظام إدارة العملية التعليمية في آفاق العقار: نحو تجربة تعليمية متكاملة ومبتكرة مقدمة أهلاً بك في آفاق العقار، المنصة …

اقرأ المزيد

Risks of Real Estate Investment in Riyadh 2025: Learn about the Risks and How to Avoid Them to Achieve Your Investment Goals 🔑

Navigating realestate investment in Riyadh 2025? 🤔 Understand the Risks of real estate investment in Riyadh 2025 – from market …

اقرأ المزيد

Option 1 (Focus on Benefits):

Installment Sale Law in Dammam 2025: Rights of the Seller and Buyer and Conditions of Installment Sale 🔑 Navigating real …

اقرأ المزيد

Option 1 (Focus on Benefits):

Common Ownership Law in Makkah 2025: Rights and Duties of Owners in Common Properties and Property Management Procedures 🔑 Navigating …

اقرأ المزيد

🌟 Lands for Sale in Dammam 2025: Explore Investment Opportunities Today! 🌟

🏡 Embrace the thriving real estate market of Dammam in 2025! Discover a wide range of lands for sale, from …

اقرأ المزيد

🏡 Apartments for Rent in Dammam at Affordable Prices 2025 💸

Are you searching for the perfect apartment in Dammam within your budget? Our 2025 guide is here to help! 🗺️ …

اقرأ المزيد

التعليقات