How to Calculate Property Tax in Madinah 2025: A Comprehensive Guide 🏡

عقارات ذات صلة

Luxury residential apartments in 6th of October

فرصة عقارية مميزة في الشرقية, الطائف, محافظة الطائف, منطقة مكة المكرمة, 26511, السعودية

محل للبيع بمارينا 4

شاليه ساحر في اللوتس 91

شقة فاخرة في اللوتس بالساحل

شقق سكنية راقية شارع الحمدي الحديدة

شاليه مطروح مطل على البحر

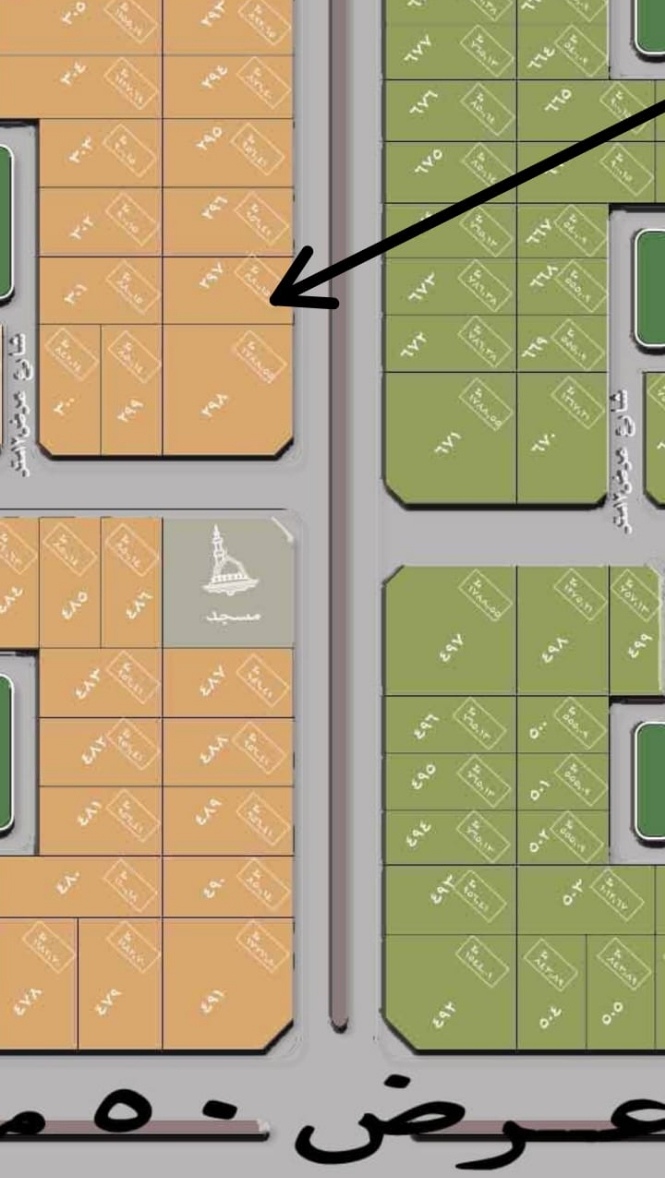

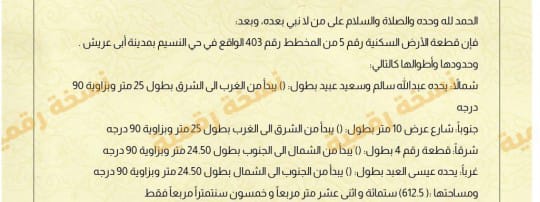

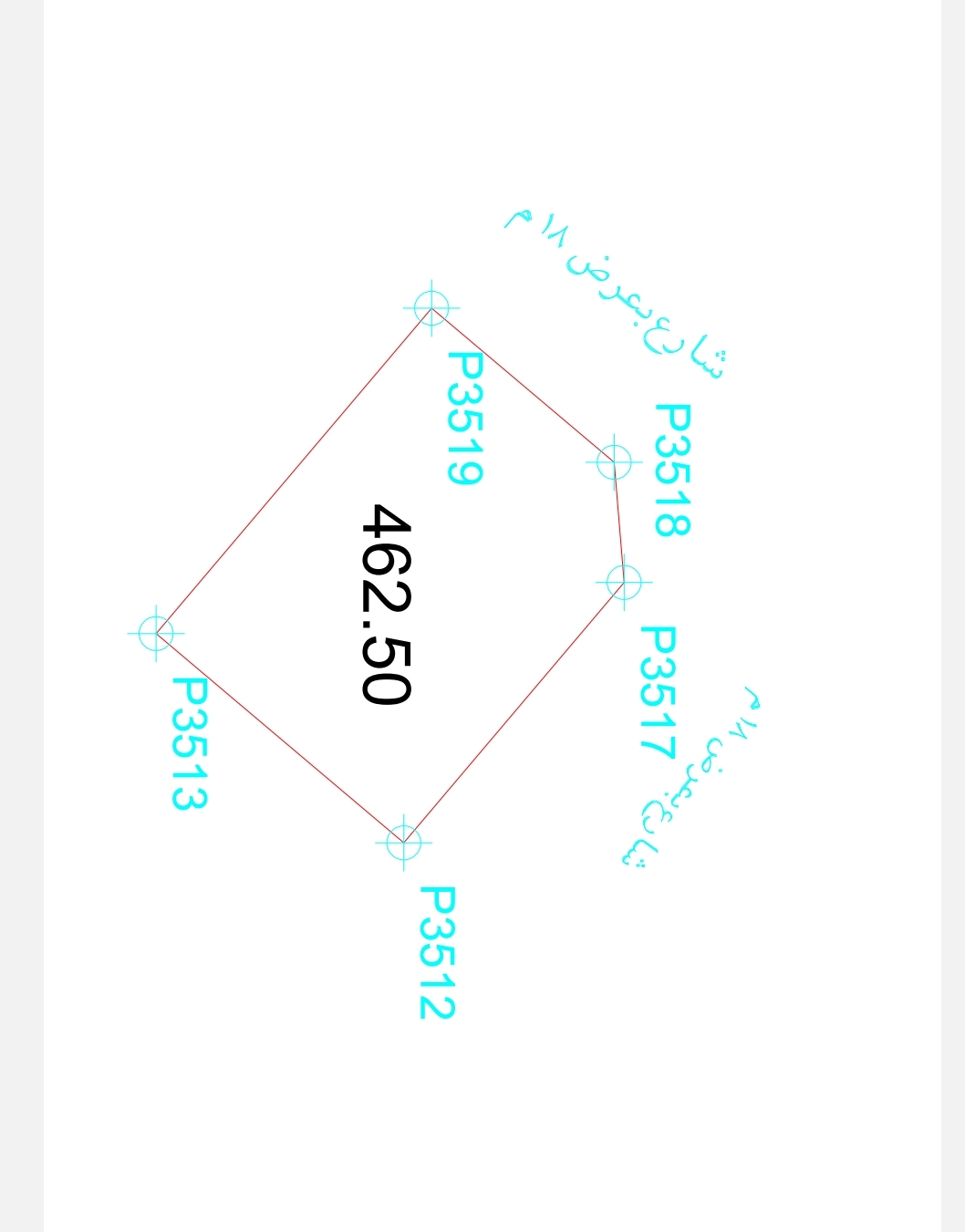

أرض في حي النهضة أبو عريش

شقة في جرين بيتش الساحل الشمالي

فرصة عقارية مميزة في محافظة صبياء, صبيا, منطقة جازان, 85454, السعودية

مقالات ذات صلة

Here's a social media post tailored to AFAQ Real Estate:

Title: Make Your Properties Shine in the Administrative Capital: Creating Professional Descriptions Using Artificial Intelligence in AFAQ Real Estate (2025) …

اقرأ المزيد

Option 1 (Focus on Contract Clarity):

Navigate Saudi real estate confidently! 🇸🇦🏡 How to Write a Real Estate Sale Contract in Dammam 2025: A Comprehensive Guide …

اقرأ المزيد

Courts Specialized in Real Estate Cases in Madinah 2025

Your Guide! ⚖️ Navigating real estate in Madinah? Understanding the judicial landscape is key! Learn about Courts specialized in real …

اقرأ المزيد![**Title:** الساحل الشمالي: كيف حول نظام CRM من آفاق العقار تحديات [اسم العميل] إلى صفقات ذهبية! (...](/media/courses/images/%E2%80%8F%E2%80%8Fdefault.jpg)

**Title:** الساحل الشمالي: كيف حول نظام CRM من آفاق العقار تحديات [اسم العميل] إلى صفقات ذهبية! (...

هل تعلم أن [اسم العميل]، أحد كبار المستثمرين في الساحل الشمالي، كان يواجه صعوبة في تتبع عملائه المحتملين وإدارة صفقاته …

اقرأ المزيد

🏡 Real Estate Disputes in Jeddah 2025: Your Guide to Resolutions 🏡

Property disputes in Jeddah are complex, but you're not alone. Discover the comprehensive guide on resolving real estate property disputes …

اقرأ المزيد

Effective and Direct Communication with Your Egyptian Customers: Integrated Messaging System in AFAQ Real Estate in the Administrative Capital (2025)

Unlock seamless communication with your clients in Egypt's Administrative Capital with AFAQ Real Estate's innovative Integrated Messaging System! Enhance Effective …

اقرأ المزيد

Here's your social media post:

Effective and Direct Communication with Your Egyptian Customers: Integrated Messaging System in AFAQ Real Estate in the Administrative Capital (2025) …

اقرأ المزيد

Old Rental Law in Jeddah 2025: Rights of Old Tenants and Changes to the Law 🔑

Navigating the Old rental law in Jeddah 2025 can be tricky! 🏘️ Understand your rights as a tenant in 2025, …

اقرأ المزيد

Real Estate Ownership Transfer Fees in Madinah 2025: Learn about the Fees, Taxes, and Costs Related to Ownership Transfer 🔑

Navigating real estate ownership transfer 2025 in Madinah? Understanding real estate ownership transfer fees 2025, real estate fees for ownership …

اقرأ المزيد

Here's your engaging social media post for AFAQ Real Estate:

Title: Streamline Communication: AFAQ Real Estate's Integrated Messaging System in the Administrative Capital! Tired of fragmented communication in the Egyptian …

اقرأ المزيد

Innovative Real Estate Valuation Application: Accurate Property Valuation in the Administrative Capital, Integrated Reports, and Analysis of Market Data (2025)

Unlock unparalleled insights into the Egyptian real estate market with AFAQ Real Estate's innovative valuation application. Get accurate property valuations …

اقرأ المزيد

Comparison of Residential Apartments in Dammam 2025: Ownership vs Rental 🏠💡

Are you considering investing in real estate in Dammam? Our comprehensive guide to ownership and rental apartments in 2025 will …

اقرأ المزيد

Law of Land Disposal in Makkah 2025

Your Guide! 📜 Unlock key insights into the Law of land disposal in Makkah 2025, covering rights of the state …

اقرأ المزيد

Tax Law in Makkah 2025

A Comprehensive Guide to Tax Types, Rates, and Their Impact on Individuals and Companies 📜 Unlock the secrets to navigating …

اقرأ المزيد

Tax Law in Makkah 2025: A Comprehensive Guide for Investors! 🇸🇦

Navigating Tax law in Makkah 2025? 🤔 Understand the types of taxes in Makkah 2025, including income taxes 2025, corporate …

اقرأ المزيد

Best Real Estate Development Companies in Madinah 2025: A List of the Best Real Estate Developers in the Region 🇸🇦

Dreaming of owning property in Madinah? 🤩 Discover the best real estate development companies 2025 shaping the city! This list …

اقرأ المزيد

Best Real Estate Development Projects in Madinah 2025: Promising Opportunities for Investment in New Projects 🌟

Unlock lucrative investment opportunities in Madinah's booming real estate market! Explore the best real estate development projects 2025, including premium …

اقرأ المزيد

How to Calculate Property Tax in Madinah 2025: A Detailed Guide Explaining the Steps and How to Use the Tax Calculator 🏘️

Unlock Saudi real estate! Navigating property tax in Madinah just got easier. Understand "How to calculate property tax in Madinah …

اقرأ المزيد

Best Real Estate Development Projects in Madinah 2025: Promising Opportunities for Investment in New Projects! 🌟

Unlock lucrative investment opportunities in Madinah's booming real estate market! Discover the best real estate development projects 2025, including premier …

اقرأ المزيد

التعليقات